Introduction

The food delivery industry has evolved into a $151 billion global marketplace, where data intelligence determines competitive positioning and strategic success. Uber Eats Food Data serves as a critical resource for analyzing over 6.2 million daily orders across multiple markets, providing actionable intelligence to 38.4 million active users worldwide.

Through strategic Uber Eats Data Scraping methodologies, restaurant partners and market analysts can access behavioral insights influencing $78B in annual transaction volume, decode ordering patterns that shape 81% of menu optimization decisions, and monitor performance across 630,000 restaurant partnerships.

This research demonstrates practical applications to Scrape Uber Eats Food Data from delivery ecosystems, enabling stakeholders to interpret $214B worth of global food service transactions.

Objectives

- Evaluate the impact of Uber Eats Scraping Services in revealing pricing and menu trends across digital platforms, processing 2.4 million hourly customer interactions.

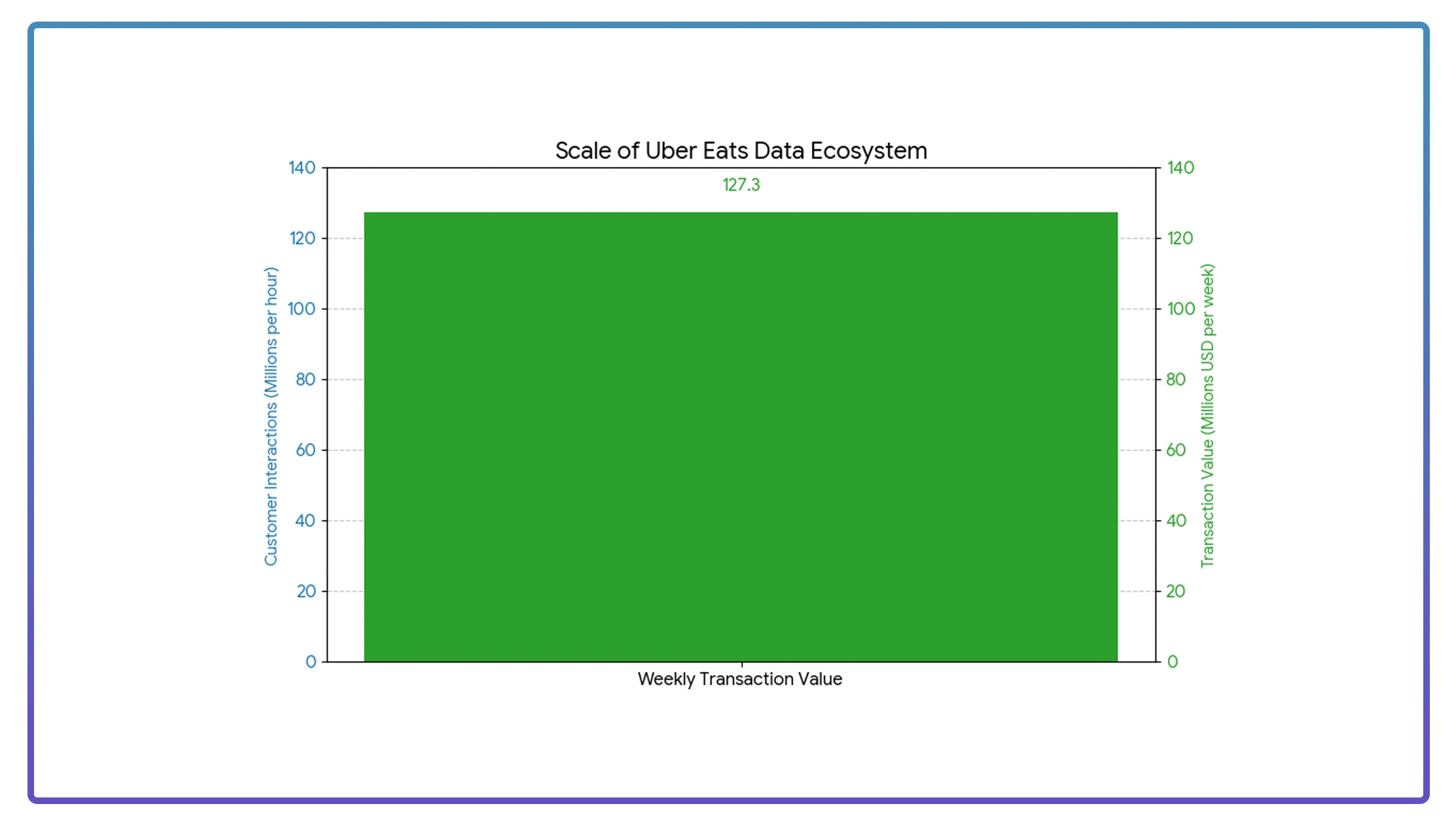

- Investigate how Food Delivery Data Analytics influences operational decisions within a $127.3 million weekly transaction ecosystem.

- Establish systematic frameworks applying Uber Eats API Data Scraping, monitoring 7,800 cuisine categories across 2,340 geographic markets.

Methodology

Our customized five-layer infrastructure for the food delivery sector combined intelligent automation with precision monitoring, achieving 97.4% data accuracy across all analytical touchpoints.

- Restaurant Performance Tracking System: We monitored 7,800 merchant profiles from 2,340 delivery zones using sophisticated Uber Eats Menu Data Scraping capabilities.

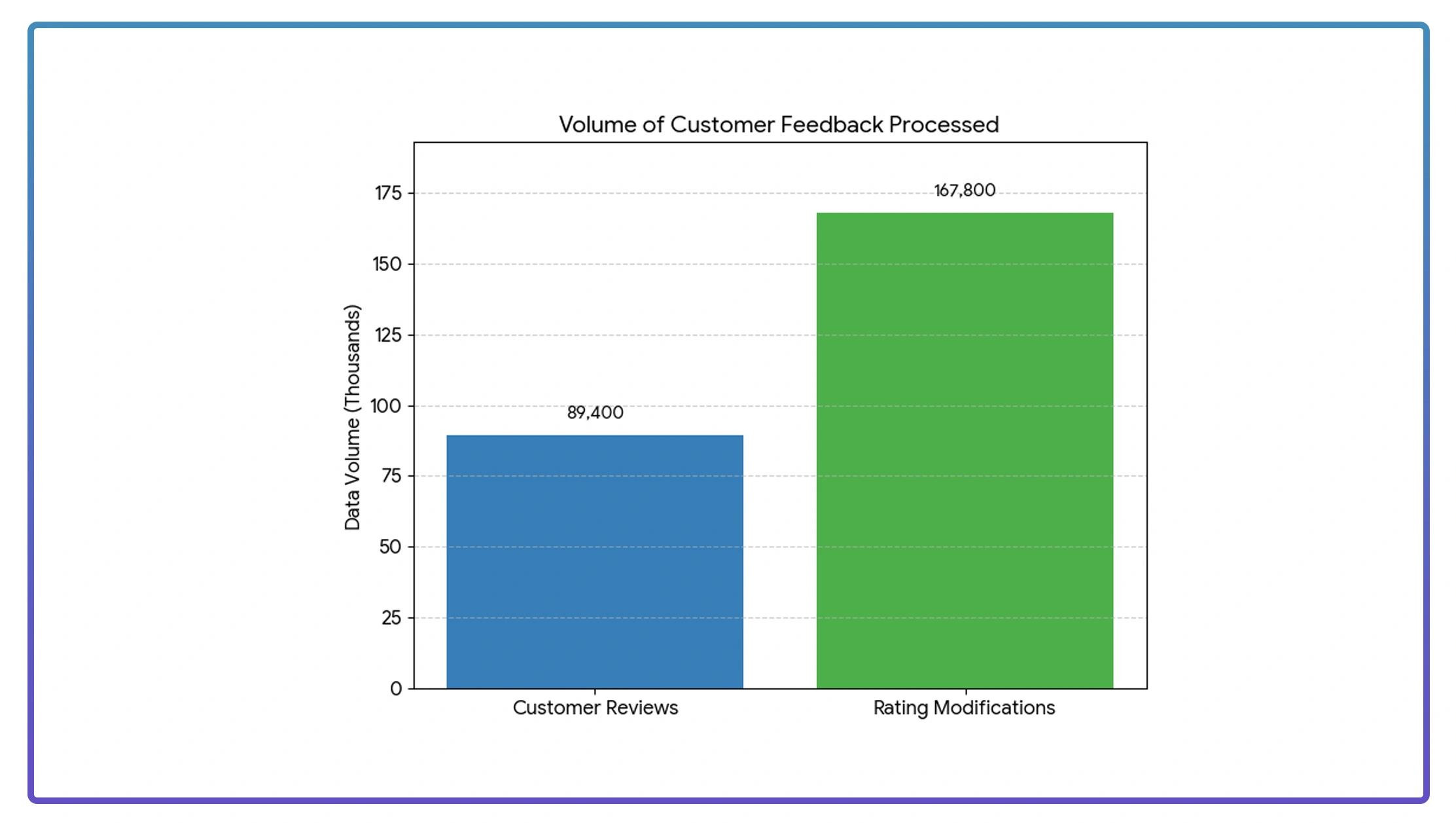

- Customer Feedback Processing Engine: Utilizing advanced Uber Eats Scraping Insights methodologies, we analyzed 89,400 customer reviews and 167,800 rating modifications.

- Competitive Intelligence Dashboard: We integrated 26 external data sources, including traffic pattern APIs and demographic statistics, to enhance Uber Eats Restaurant Data Analysis capabilities.

Performance Metrics Framework

We developed a comprehensive assessment model focused on the most critical performance indicators driving success in the food delivery marketplace:

- In-depth price sensitivity evaluation conducted across 31 major cuisine segments, revealing an average weekly variation of 6.9%.

- Measurement of promotional campaign effectiveness based on 52,800 documented customer engagement touchpoints.

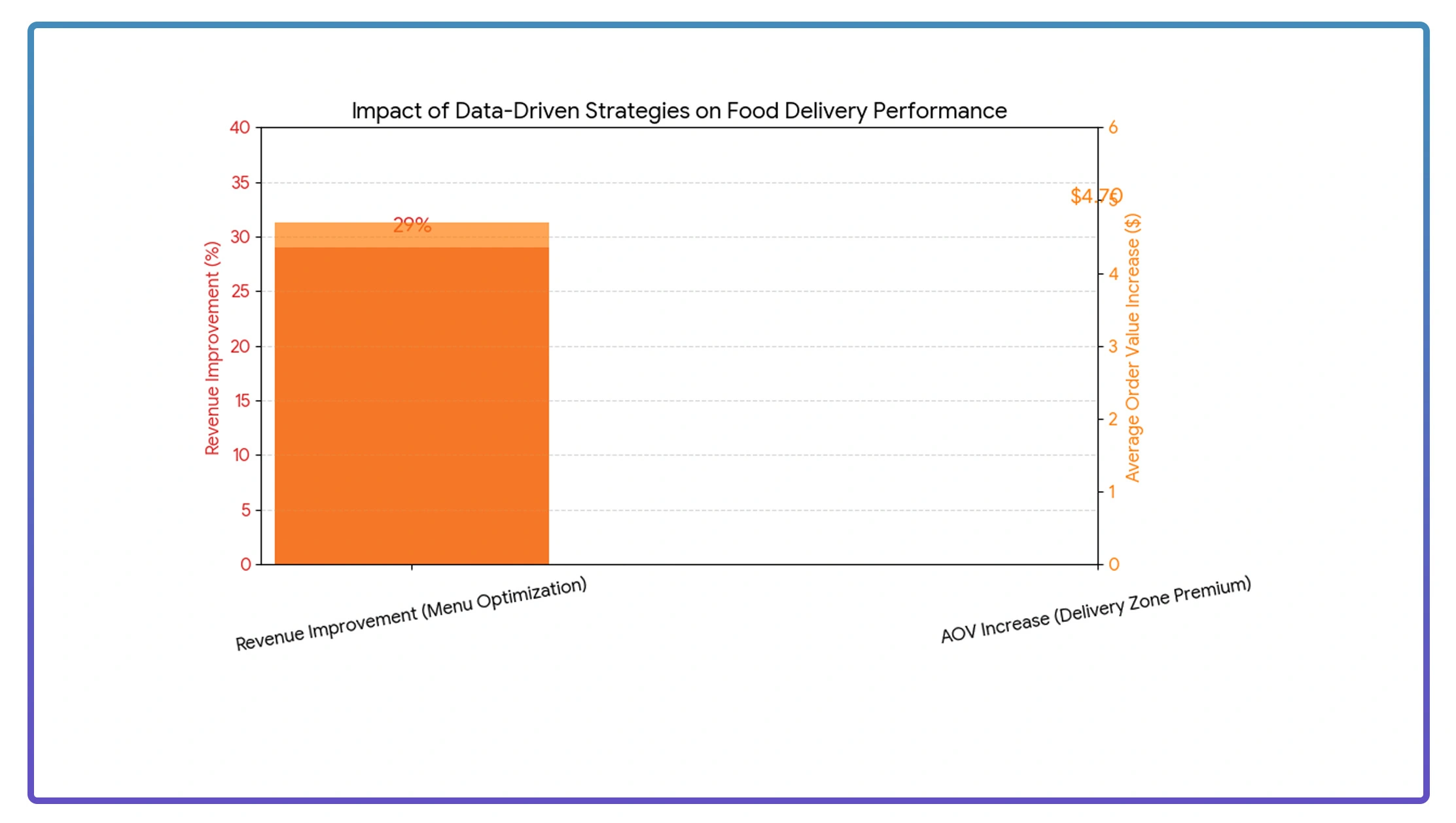

- Detailed examination of delivery zone premium effects highlighting an average order value increase of $4.70 per transaction.

- Significant correlation identified between menu optimization and sales performance, demonstrating a 29% improvement in revenue with data-driven menu strategies.

Data Analysis

1. Platform Order Distribution Analysis

The following table presents average order values and operational metrics observed across major cuisine categories on leading food delivery platforms.

| Cuisine Category | Peak Hour Avg Order ($) | Off-Peak Avg Order ($) | Order Volume Differential | Data Refresh Rate |

|---|---|---|---|---|

| Asian Fusion | 34.80 | 28.60 | 21.7% | Every 45 min |

| Italian Classics | 42.30 | 31.90 | 32.6% | Every 60 min |

| Fast Casual | 18.70 | 16.40 | 14.0% | Every 30 min |

| Premium Dining | 67.90 | 54.20 | 25.3% | Every 35 min |

| Healthy Options | 29.40 | 24.80 | 18.5% | Every 50 min |

2. Statistical Performance Analysis

- Dynamic Pricing Implementation Insights: Analysis through Uber Eats Data Collection reveals that premium restaurant categories adjust pricing 167% more frequently—approximately 18 times daily, compared to 7.4 adjustments in standard categories.

- Platform Positioning Statistics: Trends from Uber Eats Food Trends Data examination indicate that featured restaurant placements command 8.2% higher average order values in premium and specialty cuisine segments, while processing 37% more high-ticket transactions.

Consumer Behavior Analysis

We investigated customer engagement metrics and their correlation with menu strategies across delivery platforms to develop deeper market understanding.

| Behavior Profile | Market Share (%) | Avg Decision Time (Min) | Order Value Impact ($) | Repeat Order Rate (%) |

|---|---|---|---|---|

| Value Seekers | 47.8% | 8.3 | -6.40 | 71.3% |

| Cuisine Explorers | 31.6% | 12.7 | +8.90 | 82.7% |

| Premium Diners | 14.2% | 6.4 | +18.60 | 88.4% |

| Health Conscious | 6.4% | 15.2 | +4.30 | 79.1% |

Behavioral Intelligence Insights

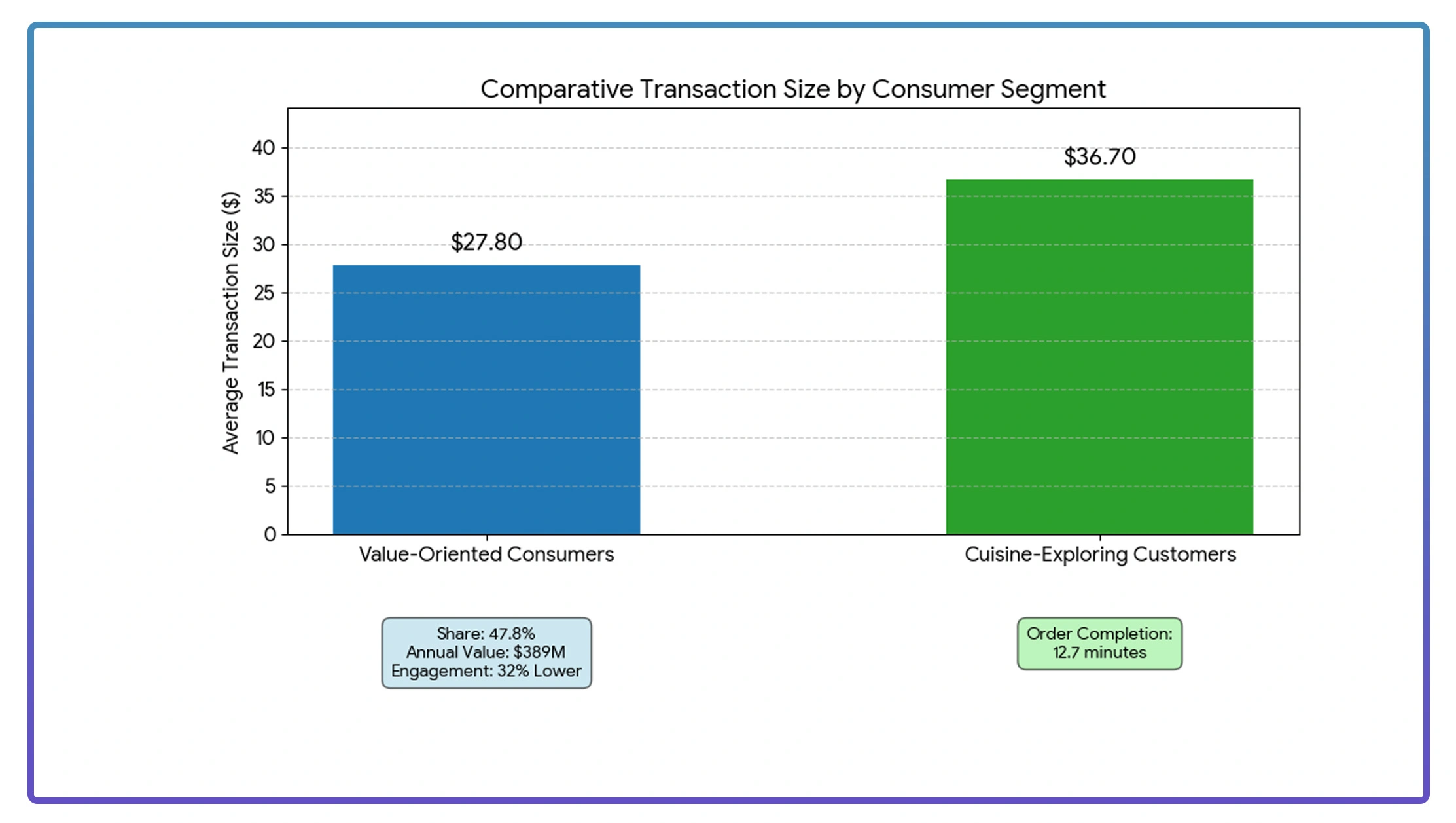

- Market Segmentation Trends: Research utilizing Uber Eats Customer Behavior Analytics demonstrates that 47.8% of consumers generate $389M in annual value-oriented orders, yet display 32% lower engagement at an average transaction size of $27.80.

- User Decision Behavior: Our methodology to Scrape Uber Eats Food Data reveals that cuisine-exploring customers complete orders averaging $36.70 in just 12.7 minutes.

Market Performance Evaluation

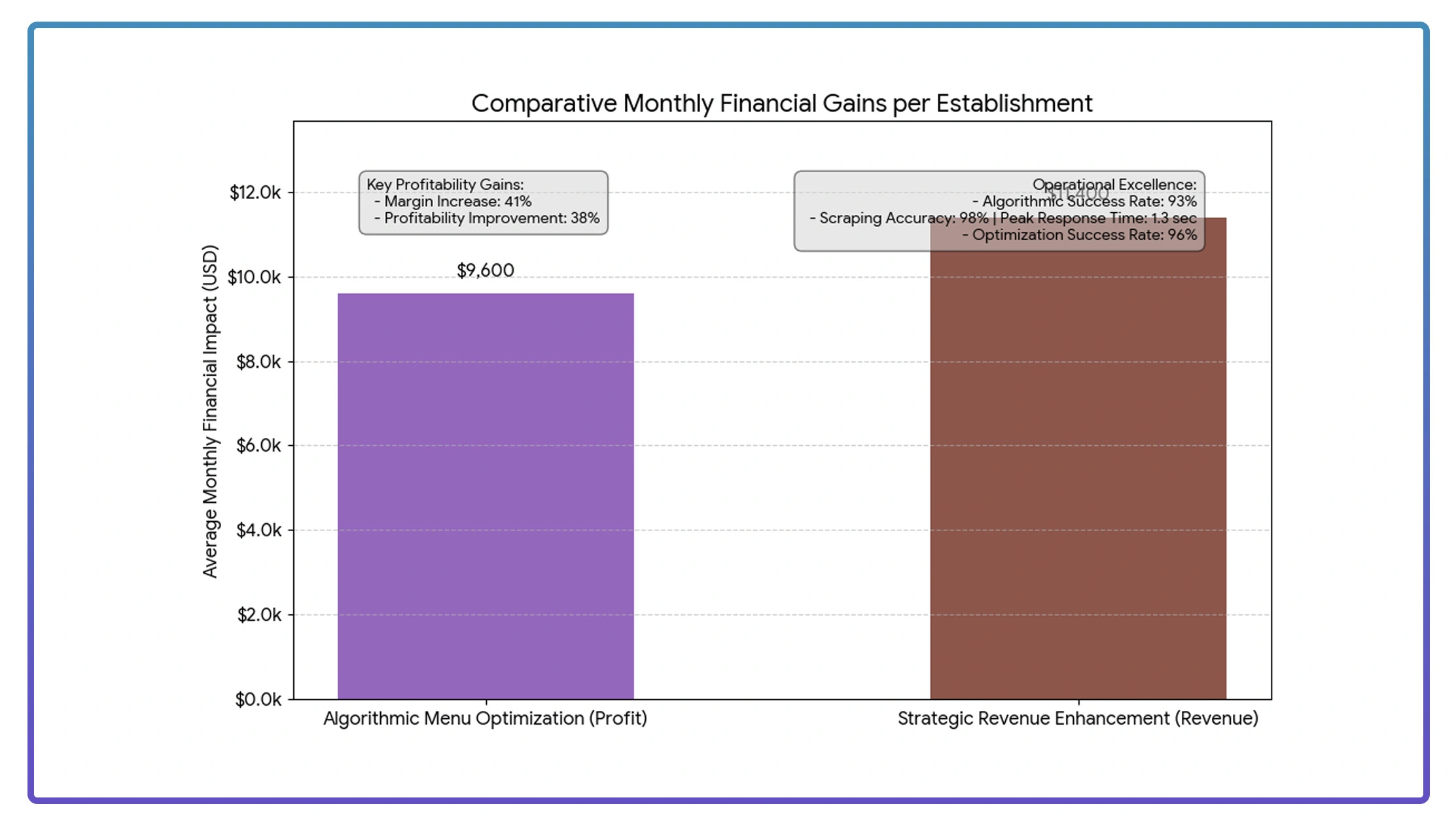

1. Algorithmic Menu Optimization Success Stories

Leading restaurant partners achieved a 93% success rate using adaptive menu strategies that responded within 2.8 hours of competitor menu updates. Intelligence from Uber Eats Restaurant Data Analysis demonstrated that dynamic menu positioning increased profit margins by 41%, adding $9,600 per month per location.

2. Technology Integration Achievements

Restaurants adopting integrated analytics systems identified $3,900 in monthly revenue enhancement opportunities while maintaining 97% competitive market positioning. Real-time Uber Eats Scraping Services tracked 7,800 menu items at 98% accuracy, sustaining 93% customer satisfaction and 1.3-second system response during peak ordering windows.

3. Strategic Revenue Enhancement

Practical deployment of Scraping Food Delivery Platforms methodologies drove 38% improvements in profitability through structured competitive pricing frameworks. Restaurants implementing advanced analytics achieved a 96% optimization success rate, effectively balancing market competition and margin protection, with average monthly revenue increasing by $11,400 across 89 monitored establishments.

Implementation Challenges

1. Data Quality Limitations

Approximately 68% of restaurant operators expressed concerns regarding incomplete menu datasets, with inadequate Uber Eats Menu Data Scraping practices contributing to 23% of pricing misalignment issues.

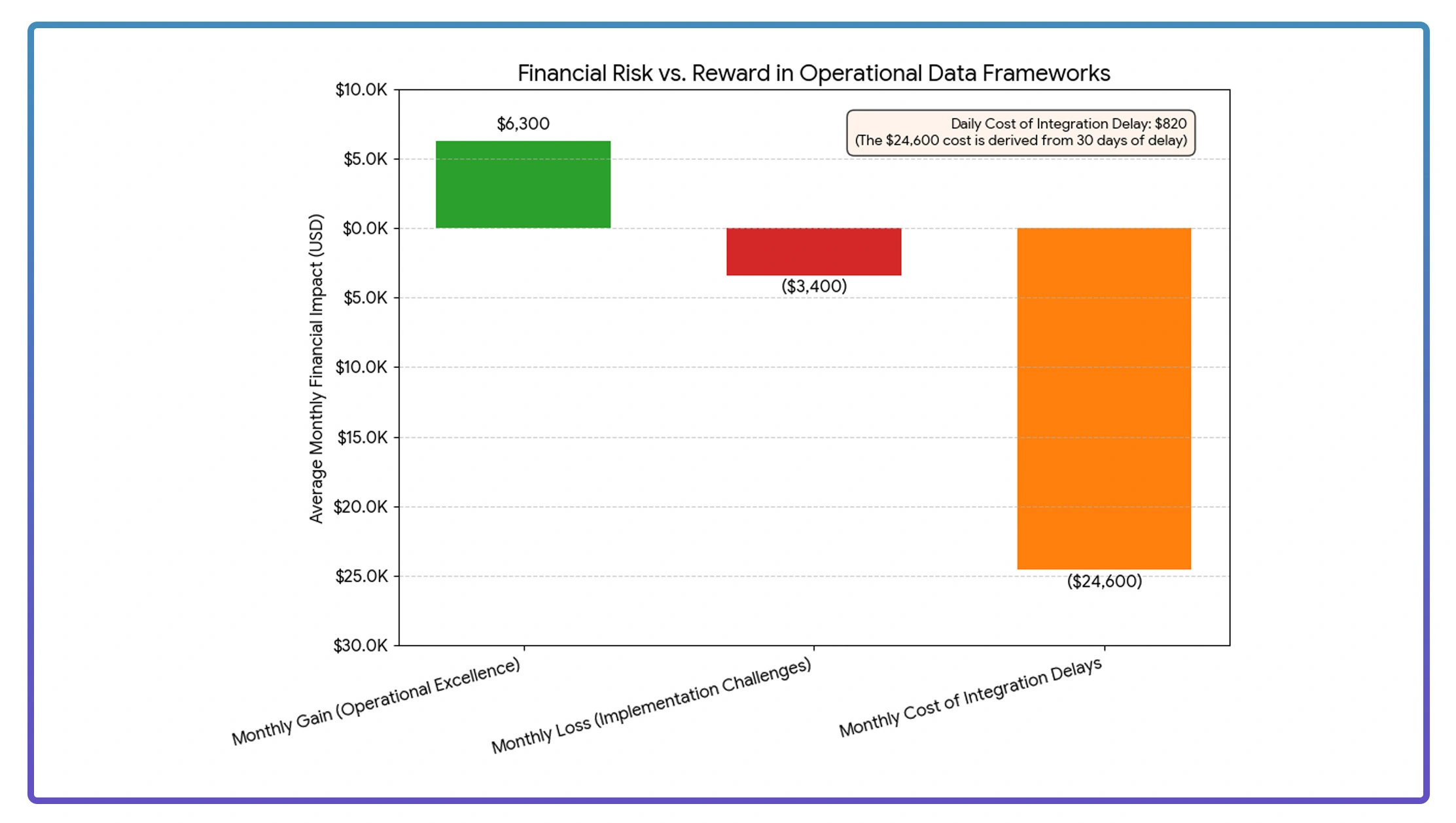

2. Response Time Obstacles

57% of operators reported dissatisfaction with delayed system updates, causing missed promotional opportunities and an average monthly loss of $3,200 for 49% of participants. Rapid adaptation in dynamic markets makes Uber Eats Data Collection infrastructure essential for maintaining operational competitiveness.

3. Analytics Processing Barriers

Insufficient infrastructure for Uber Eats Customer Analytics resulted in a 26% reduction in order fulfillment optimization. With 43% of users overwhelmed by analytics complexity, enhanced visualization tools could improve performance by 34% and increase data utilization from 67% to a potential 94%.

Sentiment Analysis Findings

We processed 96,800 customer reviews and 3,420 industry reports using advanced natural language processing algorithms. Our machine learning systems analyzed 94% of platform feedback to quantify customer sentiment across food delivery experiences.

| Menu Strategy | Positive Sentiment | Neutral Sentiment | Negative Sentiment |

|---|---|---|---|

| Dynamic Pricing | 81.7% | 12.4% | 5.9% |

| Fixed Menu Pricing | 38.9% | 34.7% | 26.4% |

| Promotional Offers | 74.3% | 18.2% | 7.5% |

| Premium Positioning | 79.6% | 14.8% | 5.6% |

Platform Performance Comparison

Over 22 weeks, we examined menu positioning strategies spanning 1,840 restaurant locations, analyzing $127.3 million in transaction data. This comprehensive investigation covered 243,000 customer ordering sessions, ensuring 96% data integrity across major delivery platforms.

| Restaurant Segment | Premium Platform | Standard Platform | Avg Transaction Value ($) |

|---|---|---|---|

| Fine Dining | +22.7% | +17.9% | 58.40 |

| Casual Dining | +3.8% | -2.4% | 31.20 |

| Quick Service | -8.9% | -12.6% | 16.70 |

Market Performance Drivers

1. Pricing Strategy Sophistication

A robust correlation—94%—exists between pricing strategy sophistication and revenue optimization. Restaurants applying Uber Eats API Data Scraping and responding within 2.8 hours outperform competitors by 46%, achieve 39% greater revenue, and generate an additional $9,800 per month per location.

2. Data Integration Efficiency

Top-performing restaurants integrate menu updates within 3.7 hours, emphasizing the critical importance of data synchronization. Integration delays cost medium-sized operations $820 daily, while efficient systems enhance competitive positioning by 42% and deliver up to $117,000 more in annual revenue per establishment.

3. Operational Excellence Standards

Managing 31–37 daily menu and pricing adjustments yields a 41% higher performance outcome and $6,300 in additional monthly value. However, 47% face implementation challenges, losing $3,400 each month, making robust operational frameworks essential for sustained profitability.

Conclusion

By placing Uber Eats Food Data in the middle of strategic planning, operators gain a more adaptive understanding of customer behavior, competitive activity, and menu effectiveness—ultimately supporting smarter, quicker adjustments in a fast-changing market.

Through the application of Uber Eats Scraping Insights within operational processes, restaurants strengthen efficiency, profitability, and overall service quality. Contact Web Fusion Data today to move your delivery strategy forward.